War Tensions Shake Bitcoin, But Strategy Drops New $26M Buy

Strategy has made yet another Bitcoin purchase, this one being announced as global tensions weigh heavy on the cryptocurrency market.

Strategy Has Added Another 245 BTC To Its Stack

In a new post on X, Strategy co-founder and chairman Michael Saylor has shared a filing made with the US Securities and Exchange Commission (SEC) for a new Bitcoin purchase.

With this $26 million acquisition, Strategy has added another 245 BTC to its holdings. This is the fourth buy that the company has made this month, although it’s the smallest of the bunch. The last purchase, announced on June 16th, was a particularly big one involving a sum surpassing $1 billion.

Following the buying spree in June so far, the total reserve of Strategy now sits at 592,345 BTC. The firm put together this stack for $41.87 billion, but today it’s worth a whopping $61 billion, implying a significant profit of almost 46%.

According to the SEC filing, the company made the latest purchase between June 16th and 22nd. Thus, it seems the company decided to buy more, despite tensions rising between Israel and Iran during the period.

Bitcoin Market Has Been Struck With Volatility After War Fears

The past day or so has been a wild time for the cryptocurrency market, induced by escalating tensions in the middle east following US strikes on three Iranian nuclear facilities.

Below is a chart that shows how Bitcoin’s recent performance has looked.

Looks like the price of the coin has gone through a rollercoaster | Source: BTCUSDT on TradingView

As is visible in the graph, the Bitcoin price plummeted hard all the way down toward the $98,000 level as panic selling ensued, but before long, the coin found a rebound. Now, the asset’s back at $102,800, which is about the same level as before the crash.

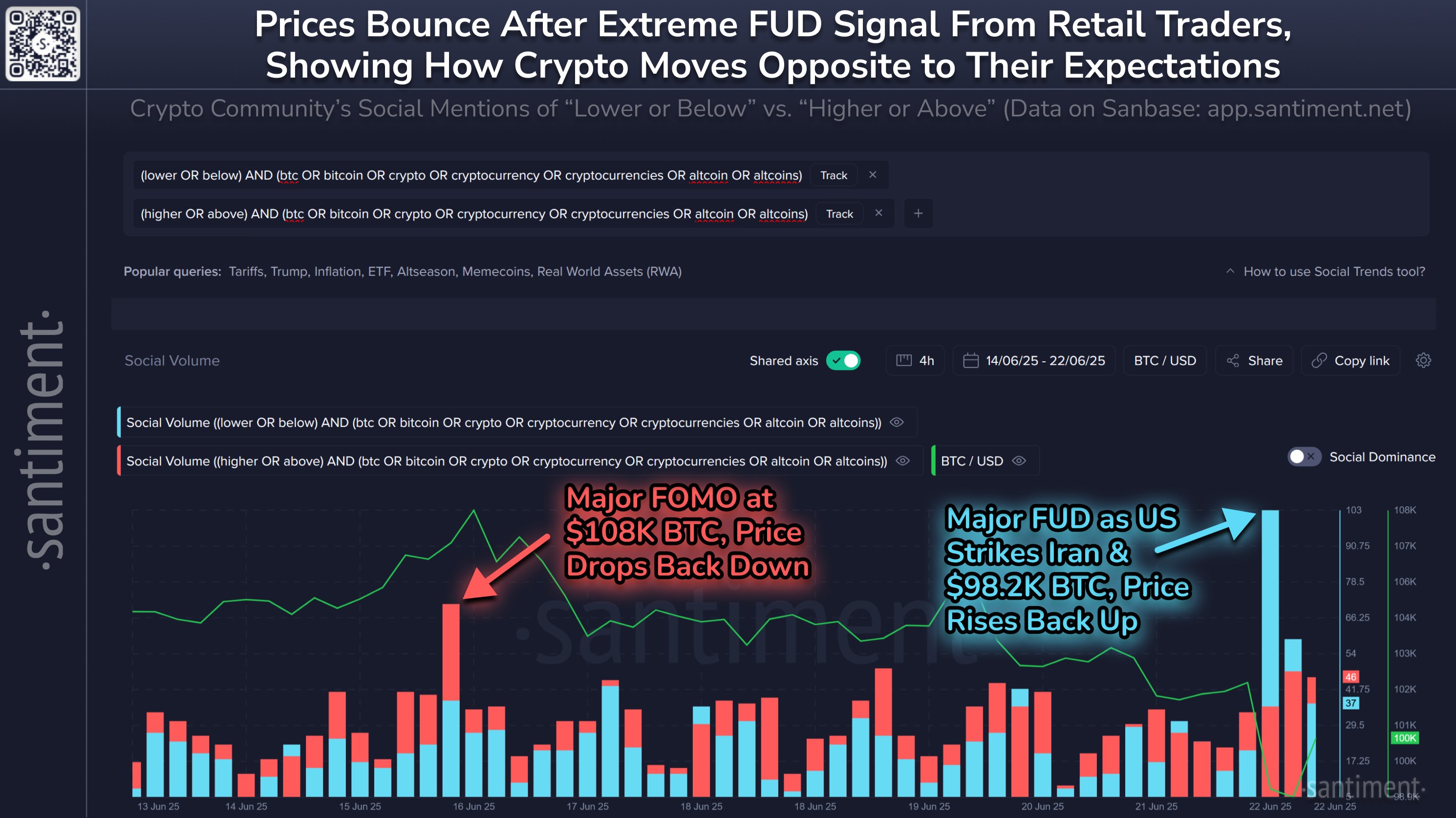

According to data from the analytics firm Santiment, the price bounce has followed the same usual pattern of retail investor sentiment acting as a contrarian signal.

The trend in the social volume of bearish and bullish calls on social media | Source: Santiment on X

In the chart, Santiment has attached the data of the Social Volume, a metric that measures the unique number of posts making mentions of a given term or topic on the major social media platforms. The analytics firm has applied keywords related to cryptocurrency and Bitcoin to the metric.

Additionally, it has also applied two separate filters: one corresponding to bearish calls (‘lower’ or ‘below’) and another to bullish calls (‘higher’ or ‘above’). From the graph, it’s apparent that the former type of posts blew up following the US strikes, indicating FUD exploded among the retail investors.

Generally, Bitcoin and other digital assets tend to move in a direction that goes against the expectations of the crowd and that’s indeed what seems to have occurred this time as well.

Featured image from Dall-E, Santiment.net, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.