Crypto Craze Among Russian Investors Surges Past 50% Mark: Study

More than half of Russia’s top investors have already dipped a toe into crypto, and most of the rest plan to follow suit.

That’s the headline result of a recent survey of 1,500 qualified investors aged over 20 in cities with more than 100,000 residents. Each participant holds at least ₽50,000 (about $600) in financial assets.

Based on reports, 52% of these investors say they’ve bought digital coins, while another 38% intend to do so. Taken together, that means 90% of the surveyed group has either embraced crypto or will likely jump in soon.

Qualified Investors Face High Entry Barriers

According to the survey, Russia’s authorities aren’t ready to let everyone trade digital assets. In March, the Bank of Russia proposed an “experimental legal regime” that would limit direct crypto trading to “highly qualified investors.”

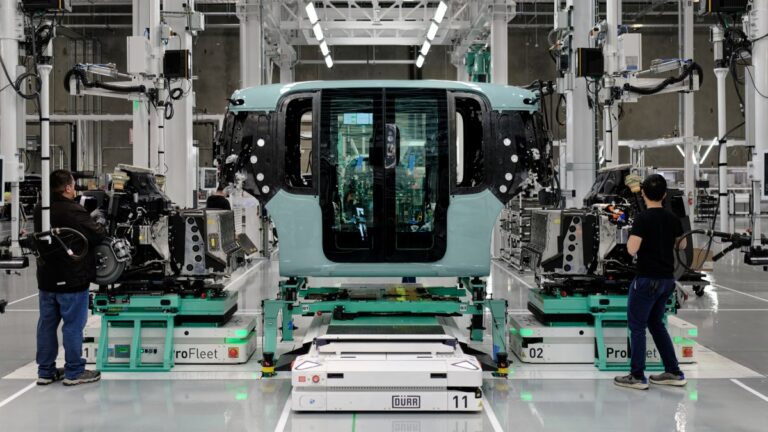

Image: Evgeny Razumny/Vedomosti

To qualify, individuals would need an annual income of at least ₽50 million (over $600,000) and at least ₽100 million (more than $1.2 million) in securities or deposits. Those thresholds still await final approval, but they make it clear that only a small fraction of the population could ever join.

Regulated Next Steps And New Products

While the central bank has no plans to add Bitcoin to its own reserves, it has opened the door to non‑deliverable crypto derivatives. That means qualified investors can buy products linked to Bitcoin prices without owning the coin itself.

In May, the bank confirmed these securities would be allowed under its pilot. Now, major players like the Moscow Exchange are lining up to launch Bitcoin futures based on a new domestic index.

As of today, the market cap of cryptocurrencies stood at $3.36 trillion. Chart: TradingView

High Trust In Russian Platforms

Domestic exchanges are gaining the battle of trust. The poll indicates 78% of investors prefer Russian-registered platforms, and 85% would like to pay for their crypto accounts in rubles.

Reliability is the number one aspect that counts (43%), followed by fees being low (24%) and simple deposits or withdrawals (24%). It seems many wealthy Russians feel safer sticking with local firms they know, rather than offshore sites.

Investment Motives And Portfolio Mix

Investors cite long‑term holdings as their top motive (57%), while 32% point to portfolio diversification and 25% to short‑term trading. About 33% of respondents currently allocate 5‑10% of their holdings to crypto‑related instruments.

Reports show these figures show that for many, digital assets are no longer a fringe gamble but a regular slice of a broader investment strategy.

Education Gaps And Market Worries

Not all barriers have vanished. Many investors say they lack deep knowledge of blockchain technology, and they worry about wild price swings.

High volatility and uncertainty remain the biggest deterrents for those who’ve held off. That suggests a clear need for better education, risk‑management tools, and perhaps simpler, regulated funds to ease newcomers in.

Featured image from Atlantic Council, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.