Bitcoin Short-Term Holder Floor Rises Toward $100,000, Reinforcing Bullish Sentiment

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

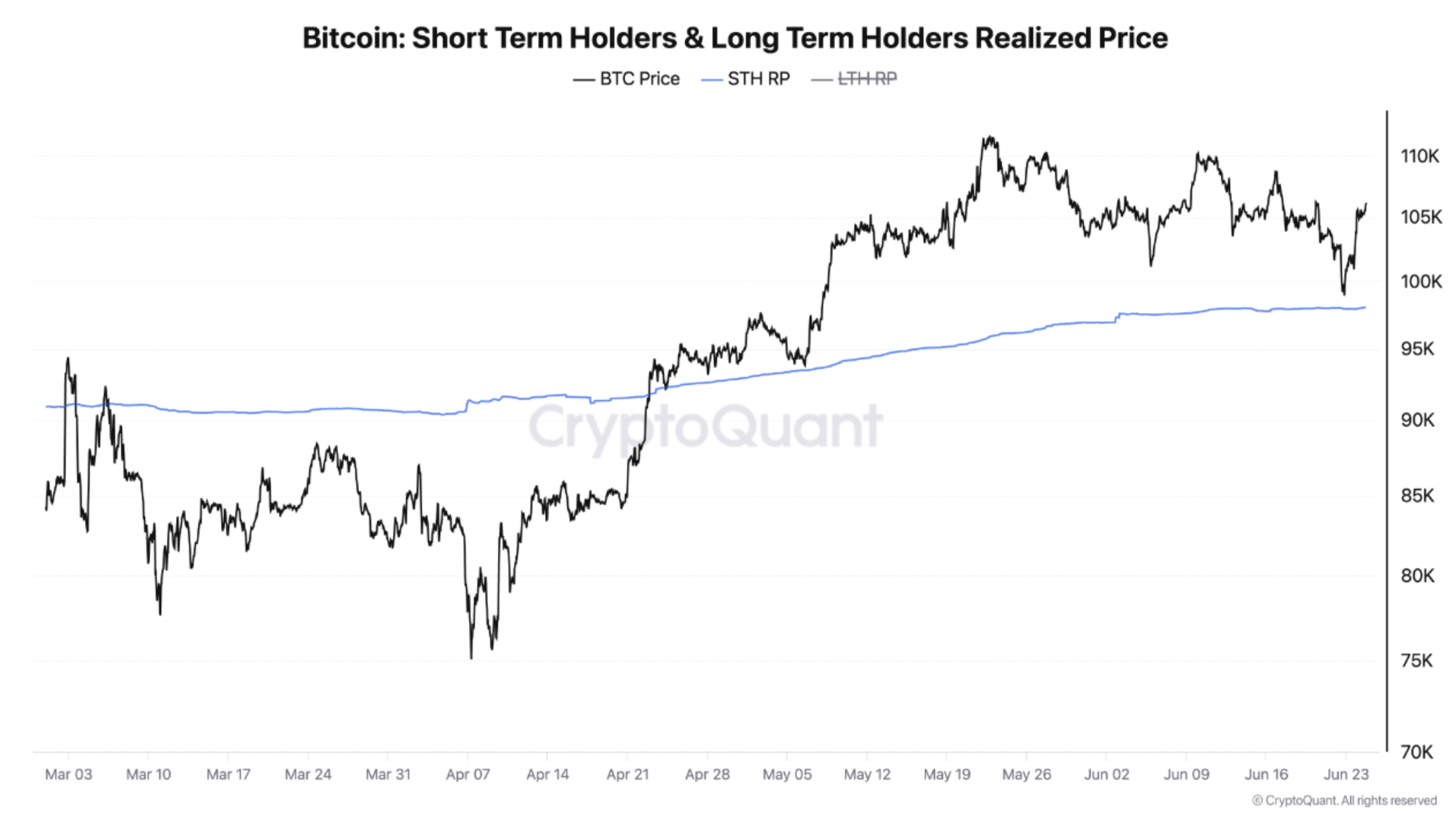

Following a quick drop to nearly $98,000 over the weekend, Bitcoin (BTC) has recovered most of its recent losses and is now trading above $107,000 at the time of writing. Fresh on-chain data suggests that the short-term holder (STH) floor for BTC has been steadily rising toward the $100,000 level.

Bitcoin STH Floor Approaching $100,000

According to a recent CryptoQuant Quicktake post by contributor unchained, Bitcoin’s STH Realized Price has been making its slow grind up toward the psychologically important $100,000 level. Notably, the analyst had earlier dubbed this metric as the “fault line” to watch.

Related Reading

For the uninitiated, the STH Realized Price represents the average price at which all Bitcoin held for less than 155 days was acquired. It acts as both a key psychological and technical support level.

When the market price stays above it, STH are in profit and more confident, whereas if it falls below, fear and selling pressure often increase. Currently, the STH Realized Price hovers around $98,000.

The analyst notes that each $500 rise in the STH Realized Price effectively resets the “new buyers’ comfort floor.” As this metric nears six figures, the mental stop-loss for newer investors also moves upward.

The following chart illustrates two recent instances where BTC bounced sharply after touching the blue STH Realized Price line. This price action suggests a bullish structure, where selling pressure diminishes as soon as BTC revisits its average cost basis.

Meanwhile, the premium – the difference between BTC’s spot price and STH Realized Price – currently hovers around 7.2%. A shrinking premium, typically under 10%, has historically signalled reduced market froth and often preceded the next leg up once open interest began to rebuild.

On the long-term side, the long-term holder (LTH) Realized Price remains largely unchanged at $32,000, roughly one-third of the STH Realized Price. The analyst observes that these long-term coins are likely held in cold storage, indicating “strong hands” with little incentive to sell. They concluded:

The blue line is climbing relentlessly; as long as BTC lives above it, the prevailing tide is still higher-lows, higher-highs. Lose it on a daily close, and we get our first real gut-check since April – otherwise the bull engine is merely cooling its cylinders.

Experts Predict New High For BTC

As BTC’s STH Realized Price continues to surge higher – resulting in a higher floor price for the digital asset – several crypto experts seem to agree that the cryptocurrency may soon reach a new all-time high (ATH) in the coming months.

Related Reading

For instance, Bitcoin is forming a bullish inverse head and shoulders pattern on the three-day chart, eyeing a potential ATH of as high as $150,000. At press time, BTC trades at $107,711, up 2.1% in the past 24 hours.

Featured image from Unsplash, charts from CryptoQuant and TradingView.com