SUI Cloud Zones Tell A Story — And The Next Chapter Could Be Parabolic

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

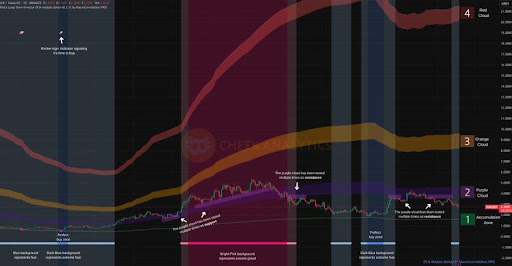

SUI’s price chart, marked by expanding cloud zones, reflects shifting sentiment and market structure. These zones have tracked major moves from fear-based accumulation to key resistance points. With new formations developing, a potentially parabolic move could be on the horizon.

Perfect Setups For SUI That Paid Off Big

Cheek Analytics, in a recent X post, identified $1.57 as SUI’s fundamental price and an ideal buy zone, especially during periods of fear. Historical data show that entering at this level on August 3, 2024, could have yielded up to a 957% gain, while a similar setup on April 7, 2025, has already returned up to a 134% gain at its peak.

Related Reading

Cheek Analytics also pointed to the Purple Cloud around $4 as the first significant resistance SUI needs to clear. This zone has been tested several times, with one brief breakthrough, only for the price to fall back and validate it as resistance. Cheek views this level as a key barrier: breaking above it would shift the momentum decisively and set the stage for further gains.

Looking further ahead, Cheek Analytics highlighted the Orange Cloud at $9 as SUI’s major resistance zone. Historically, once the purple zone is broken, price often accelerates toward this level. However, during a past attempt, growing cloud zones stalled the move, and sentiment shifted to extreme greed, triggering profit-taking. SUI later retraced by -52% and still trades -28% below its peak.

To round out the roadmap, Cheek Analytics introduced the Red Cloud at $20 as the long-term target zone, a region that could come into play if the orange cloud flips to support. However, Cheek notes that on larger altcoins like SUI, the red cloud is rarely touched. This is because all cloud zones expand or contract with market movement.

Higher Highs Needed: The Path To Breaking Resistance

Cheek Analytics concluded that SUI shows strong long-term potential, as seen in its expanding cloud zones. However, for further upside, the price must form higher lows and higher highs; otherwise, a breakout above the purple cloud may fail and attract renewed selling pressure.

Related Reading

If the bullish structure fails to materialize, the analyst warns of a likely retracement back toward the fundamental green line at $1.57, a level described as an ideal accumulation point for long-term believers, or as they put it, “buttlievers.”

Currently, the sentiment indicator is already showing fear, marked by a light blue background. Should price revisit the green line, Cheek Analytics expects sentiment to shift into extreme fear, setting the stage for optimal dollar-cost averaging (DCA) conditions for committed holders aiming to ride the next major wave.

Featured image from Shutterstock, chart from Tradingview.com